Murkowski: Raising Taxes on Oil Producers Will Not Lower Gas Prices

WASHINGTON, D.C. – U.S. Sen. Lisa Murkowski, R-Alaska, today took to the Senate floor to speak in favor of decreasing America’s dependence on OPEC imports by increasing domestic oil production. Murkowski made her comments during debate over legislation offered by Democrats to increase taxes on American oil producers by about $2 billion a year. The full text of her speech is below.

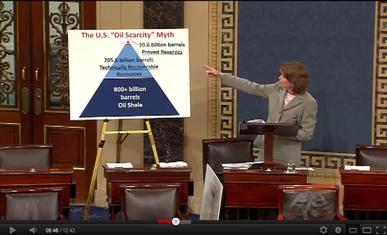

(Click video to watch speech)

“I rise in opposition to the proposal to raise taxes on American energy companies and prices to American consumers. This is not a new idea, but it certainly remains a bad one. It’s a messaging bill that has failed over and over, and it deserves that same fate again today.

“To be honest, I’m a little surprised the Senate is devoting time to this bill. Despite the President’s talking points, we are already on record here – clearly and repeatedly. This very Congress, less than a year ago, already rejected these same tax hikes. Anyone curious to know how all 100 members of the Senate voted needs only to look up vote number 72 from May 2011.

“In light of this legislation, it’s also amazing that Republicans are the party accused of welcoming high gasoline prices. With oil above $100 a barrel, the President claims we see a ‘political opportunity’ to call for greater domestic energy production.

“I get a weekly summary of what’s happening with gas prices around my state. Right now the average price of a gallon of regular unleaded here in the U.S. is just shy of $4. In my hometown of Anchorage, we’re paying $4.14. In Juneau, our state capitol, we’re paying $4.24. In Barrow, on top of the world, they’re at $5.75. Bethel is paying $6.33. They long for the day when they could be paying closer to $4 a gallon. We are so far beyond the national average. My constituents don’t view higher gasoline prices as any kind of political opportunity. What they are asking for is that we do more. In fact, it’s imperative that we here in Congress do more to address high prices.

“There is no question that we can bring several million additional barrels of American resources to market – and there’s no question that would create jobs, generate revenues, and better insulate our nation from the instability of the global markets. Every time Iran is mentioned, everything gets a little shaky out there and we know that so much of this is due to the fact that there is so little spare production capacity. What we propose would help solve that problem.

“The President has suggested time and time again that we’ve only got 2 percent of the world’s reserves. This myth about U.S. scarcity is exactly that – a myth. When he talks about proven reserves, he’s talking about just a small piece – 20.6 billion barrels – of our total resources. What needs to be understood is that we actually have incredible national reserves of 205.6 billion barrels of technically recoverable resources. That doesn’t even count the 800 billion-plus barrels of oil shale that are out there. So you might ask, why aren’t we going after the rest of those resources? The problem we face is that so much of our resources are put off-limits because of our federal government’s policies.

“Now I recognize that there is more to a national energy policy than just drilling, but it must be a significant part of the solution if we’re going to talk about true North American energy independence. We need to do more when it comes to conservation and efficiency, too. We need to build out toward the renewable energy of the future. If you want to reduce our message to a bumper-sticker, it’s ‘Find More, Use Less.’ Pretty simple.

“The opposite is true of the bill before us today. What the President and Democratic leadership are proposing cannot, by definition, reduce gas prices. If anything, it would push them higher. My constituents back home just can’t afford to see gas prices go any higher when they’re already paying above $5 and $6 a gallon. We know from basic economics that taxing something does not make it cheaper or more abundant. And we know from past experience – due to a failed experiment with a windfall profits tax that harmed domestic oil production and collected far fewer revenues than expected – that this is a bad idea.

“Again, our problem is high fuel prices and their effect on average Americans. I have yet to hear anyone explain how raising taxes will lower those prices. Even looking at the subsidies extended here, I see a couple of small provisions related to biofuels and one for infrastructure – that’s the extent of anything related to transportation fuels. So I’m left at a loss to understand how permanent tax increases for oil and gas producers, in exchange for another year of subsidies for efficient appliances and renewable energy, will make any meaningful difference. It says to the American people: well, too bad about $4 gasoline – but how about a government-subsidized dishwasher that doesn’t work as well?

“Some will also come here to argue this will have no effect on production. To respond to that, I want to submit two news stories from last week to the record. These are news articles, not editorials. One is from Platt’s, the other from The Wall Street Journal. Both detail an announcement from the British government that it will reverse its own tax increase on oil companies. Last year, England decided to do essentially what is being proposed here – to react to high oil prices by raising taxes on the industry. The result shouldn’t surprise anyone. When the government made it less economical to produce oil by hiking taxes, companies stopped producing and made their investments elsewhere. In the year since Great Britain imposed its tax hikes, its production decline has tripled from 6 percent to 18 percent.

“Let me repeat that. In the year since Great Britain imposed tax increases on oil producers, production declines accelerated from 6 percent a year to 18 percent a year. And now, Britain is in the process of doing an about face, and will likely offer $5.5 billion in tax relief to oil companies to try to bring production back. I’m sure some of my colleagues would refer to that tax cut as a subsidy, and ignore the inconvenient fact that higher taxes lead to lower production – not cheaper fuel.

“And yet, even in the face of high fuel prices and compelling empirical evidence, the proposal in front of us would take us down the same path as Great Britain. It would make the clear mistake of driving production away when we need it most. The outcome in England helps prove that this is a seriously defective idea and frankly a dangerous one. Just look at the evidence.

“If the Senate was serious about addressing gasoline prices, we would be taking long-overdue steps to increase domestic oil production and supply from Canada – as our colleagues in the House have. That’s not the only solution; it is one solution and something Congress can actually influence. Our current policies artificially limit supply from Alaska, from the Outer Continental Shelf, and from the Rocky Mountain West. We still import half of our oil supply, and about half of that is from OPEC. The end result is that we pay several hundred billion dollars a year to import oil into our country. I cannot fathom why Congress would react to that tremendous drain on our economy by raising taxes on the very businesses that help minimize our foreign dependence .”

###