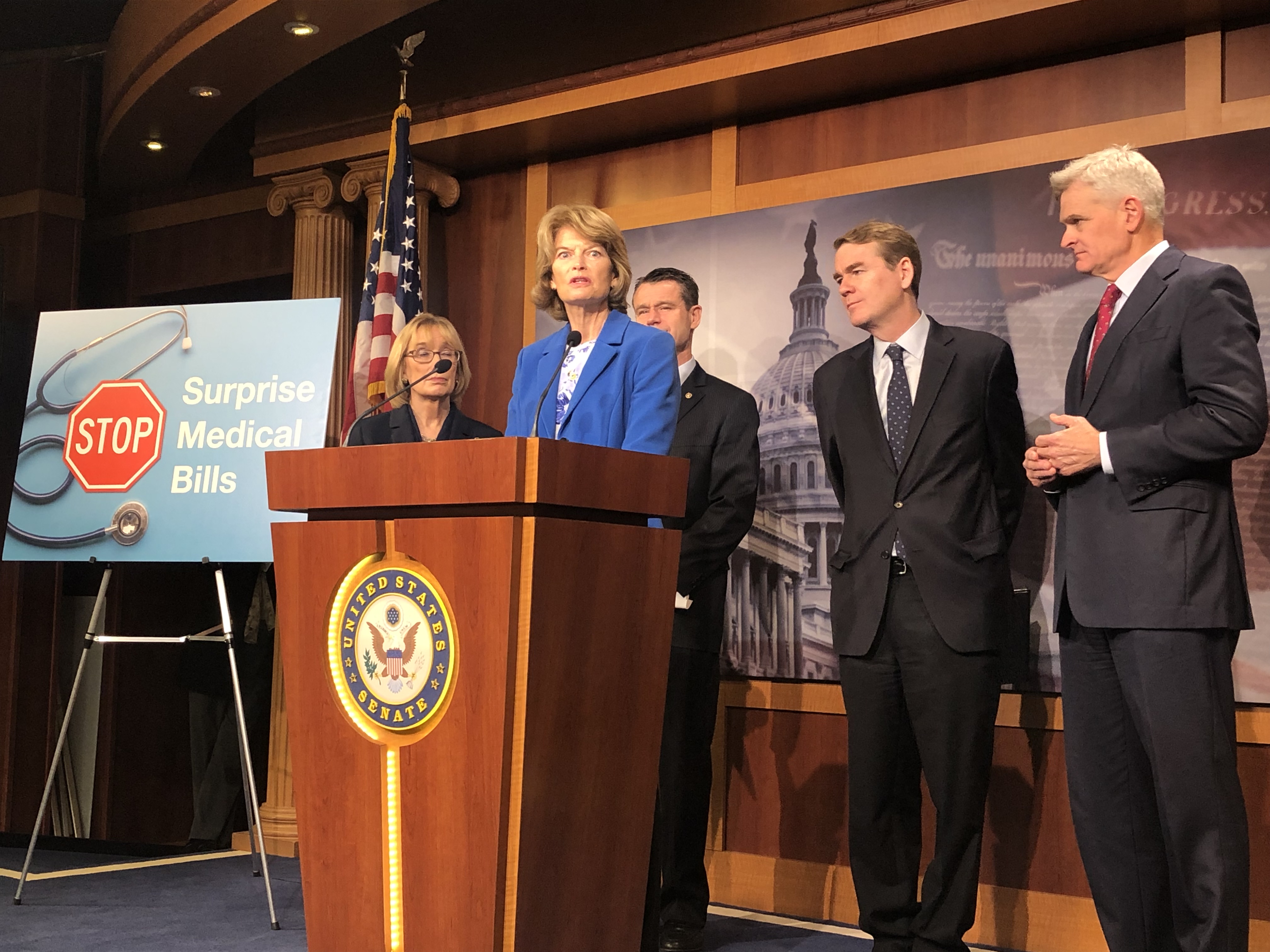

Bipartisan Senate Working Group Introduces Surprise Medical Billing Legislation

U.S. Senators Bill Cassidy, M.D. (R-LA), Michael Bennet (D-CO), Todd Young (R-IN), Maggie Hassan (D-NH), Lisa Murkowski (R-AK), and Tom Carper (D-DE), members of the Senate Bipartisan Working Group, today introduced the bipartisan STOP Surprise Medical Bills Act, legislation to protect patients from surprise medical bills. U.S. Senators Dan Sullivan (R-AK) and Sherrod Brown (D-OH) are also cosponsoring the bill.

This legislation is a product of a nearly year-long effort revising proposals and requesting feedback on draft legislation released last September by Cassidy, Bennet, Young and Carper—and legislation introduced last Congress by Hassan.

Examples of patients receiving surprise medical bills include a patient who received a bill of nearly $109,000 for care after a heart attack, and a patient who received a bill for $17,850 for a urine test.

(Click here to watch video of Senator Murkowski.)

“Patients should be the reason for the care, not an excuse for the bill,” said Dr. Cassidy. “We have worked for almost a year with patient groups, doctors, insurers and hospitals to refine this proposal. This is a bipartisan solution ensuring patients are protected and don’t receive surprise bills that are uncapped by anything but a sense of shame.”

“The last thing a patient should have to worry about is being blindsided by unanticipated, and potentially financially devastating, medical bills. People deserve to know how much they are paying for health care services and procedures at the point of care,” Senator Bennet said. “Our bill would help protect patients from surprise medical bills, increase transparency and alleviate the financial burdens imposed on consumers as a result of these bills. I urge my colleagues to prioritize this bipartisan legislation to give much needed relief and predictability to Americans throughout the country.”

“Too many American families have been hit with costly surprise medical bills at their most dire time of need. This includes Hoosiers who have been caught off guard by huge unexpected medical costs despite doing their research in advance,” said Senator Young. “Our approach protects families from financial strain by establishing a process that keeps patients out of these billing disputes and enables them to focus on their health rather than unexpected medical bills.”

“People get health insurance so they won’t be surprised by health care bills,” Senator Hassan said. “It is outrageous and completely unacceptable that people in New Hampshire and across the country do everything they’re supposed to in order to ensure that their care is in their insurance network and then still end up with large, unexpected bills from an out-of-network provider. There is strong bipartisan momentum behind ending the absurd practice of surprise medical bills and I am hopeful that we can pass this legislation and get it signed into law without delay.”

“Many Americans struggle to afford healthcare so the last thing they need is to get hit with unexpected costs added to their already high medical bills. Whether it’s an emergency surgery or an elective procedure, this legislation helps to protect patients from unexpected expenses and ensures greater transparency of costs,” said Senator Murkowski. “This bill is the result of months-long bipartisan efforts in the Senate, and I’m encouraged to know that there is also movement on this initiative in the House and support from the Administration. It’s long past time for an all-hands on deck effort to address the rising costs of healthcare.”

“In the past year, it’s estimated that four out of 10 Americans have received medical bills that they didn’t plan for. No American should have to file bankruptcy or fall into poverty as a result of a serious ailment or unexpected medical emergency,” said Senator Carper. “And Democrats and Republicans agree – we can do better. It’s why today, I’m joining my colleagues from both sides of the aisle to introduce a bill that seeks to protect patients from surprise medical bills. This bill puts the burden of negotiating prices of medical procedures on the insurer and provider, and, as much as possible, takes the burden off of the patient. Put simply, patients should be able to focus on getting healthy rather than having to negotiate over their medical bills.”

“When you’re rushed to the hospital for a heart attack, the last thing you or your loved ones should have to worry about is whether the nearest hospital is in-network,” said Senator Brown. “Ohioans work hard and pay their insurance premiums every month and this bill makes sure it will be there for them if an emergency happens.”

“This bipartisan proposal would ensure that no patient will ever again be subject to outrageously high ‘surprise bills’ as the result of a hospital visit,” said John Rother, President and CEO of the National Coalition on Health Care. “Americans should have confidence that they will be treated fairly the next time they visit an emergency room. The National Coalition on Health Care commends Senators Cassidy and Hassan for their leadership on this issue, and we urge swift consideration by the Congress. Health care is expensive enough without families being subjected to price gouging just when they are most vulnerable.

“We work every day with patients who have done everything right—have insurance, inquire about network status—but they're still caught in the middle of a system over which they have no control. They still wind up with enormous surprise bills,” said Alan Balch, CEO of the National Patient Advocate Foundation. “We are excited to see lawmakers working together to create a more fair system for patients and their families.”

Click here to see the section-by-section.

The STOP Surprise Medical Bills Act addresses three scenarios in which surprise medical billing (also known as “balance billing”) would be prohibited:

- Emergency services: The bill would ensure that a patient is only required to pay the in-network cost-sharing amount required by their health plan for emergency services, regardless of them being treated at an out-of-network facility or by an out-of-network provider.

- Non-Emergency services following an emergency service at an out-of-network facility: This bill would protect patients who require additional health care services after receiving emergency care at an out-of-network facility, but cannot be moved without medical transport from the out-of-network facility.

- Non-Emergency services performed by an out-of-network provider at an in-network facility: The bill would ensure that patients owe no more than their in-network cost sharing in the case of a non-emergency service that is provided by an out-of-network provider at an in-network facility. Further, patients could not receive a surprise medical bill for services that are ordered by an in-network provider at a provider’s office, but are provided by an out-of-network provider, such as out-of-network laboratory or imaging services.

Providers would automatically be paid the difference between the patient’s in-network cost-sharing amount and the median in-network rate for these services, but providers and plans would have the opportunity to appeal this payment amount through an independent dispute resolution process, should they see fit. This “baseball-style” process would entail the plan and provider submitting offers to an independent dispute resolution entity that has been certified by the Secretaries of HHS and the Department of Labor. This entity would make a final decision based upon commercially-reasonable rates for that geographic area.

The patient is completely removed from this process between the provider and the plan, and regardless of any outcome from a dispute resolution process, the patient still only owes the in-network rate. States that have established an alternate mechanism for protecting patients and determining payment amounts for providers would be able to continue with those systems.

A study from the Georgetown University Health Policy Institute reviewed the implementation of a similar law to address surprise medical billing in New York. New York’s law takes patients out of the middle of payment disputes between providers and plans and uses a “baseball-style” approach to settle payment disputes when the providers and plans can’t reach an agreement on their own.

The study found that state officials have seen a “dramatic” decline in consumer complaints about surprise medical billing since the law went into effect, that independent arbitrator decisions were essentially even between plans and providers, and that the vast majority of cases were resolved before needing to go to arbitration. The study points out that the state law does not cover ERISA plans, underscoring the need for federal action.