Senate Passes Comprehensive Tax Reform Bill

Pro-Growth, Pro-Economy, Pro-Jobs

U.S. Senator Murkowski (R-AK) cast her vote in favor of the Hatch-Murkowski Tax Cuts and Jobs Act, comprehensive tax reform that aims to encourage the economic growth needed to create jobs and generate wealth, while reducing taxes. The legislation contains a section written by Senator Murkowski that opens a small portion of the non-wilderness 1002 Area of the Arctic National Wildlife Refuge (ANWR) for responsible energy development. The combination of developing more of our natural resources and stimulating America’s economy through tax cuts will create opportunities for our nation and put more dollars back into the pockets of hard-working Americans.

“This bill provides relief for hardworking Alaskans and their families by doubling the standard deduction, increasing the child tax credit, and reducing the tax brackets at every income level. It stimulates economic growth and takes the actions we need to get the economy back on track,” said Senator Murkowski. “The hallmark of this bill is job creation - jobs that put food on the table and allows families the opportunity to put their children through college. The kind of jobs that allow Alaskans to build up their savings to cope with the unexpected and to retire with peace of mind. This bill provides a tremendous opportunity for small businesses, which make up 99 percent of the businesses in Alaska, making this a huge win for our state.”

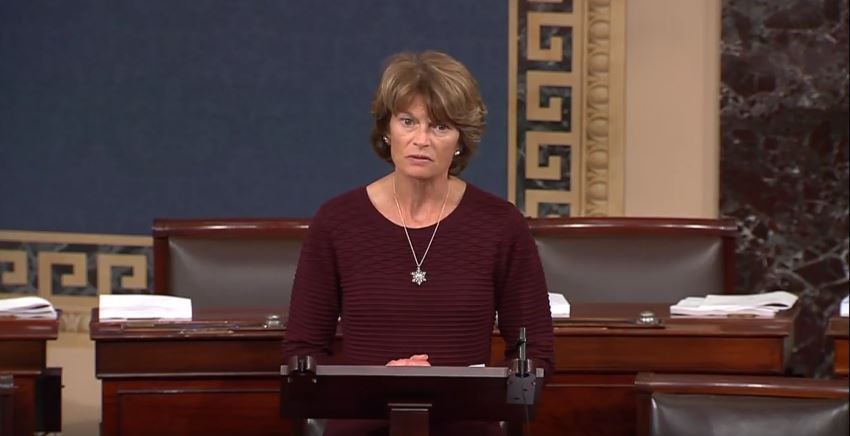

(Click image to watch video of Senator Murkowski’s floor speech.)

Title II of the Tax Cuts and Jobs Act, which was written by Murkowski as chairman of the Committee on Energy and Natural Resources, opens a small portion of the non-wilderness 1002 Area of ANWR for responsible energy development. It establishes an environmentally protective oil and gas development program with two lease sales required over the next ten years, and puts Alaska and the entire nation on a path toward greater economic prosperity for decades to come.

“Tonight is a critical milestone in our efforts to secure Alaska’s future,” Murkowski said. “Opening the 1002 Area and tax reform both stand on their own, but combining them into the same bill, and then successfully passing that bill, makes this a great day to be an Alaskan. I thank all of the Senators who spent time learning about our opportunities and needs, and who joined us tonight in voting for Alaska. We are grateful for their support and eager to take the next steps for this pro-jobs, pro-growth, and pro-energy legislation.”

Additional Bill Highlights:

- Double the Standard Deduction: For an individual, the standard deduction goes from $6,350 to $12,000. For joint filers, it goes from $12,700 to $24,000.

- Double the Child Tax Credit: The child tax credit is doubled from the current $1,000 to $2,000, and more parents are allowed to claim the credit.

- Lower Tax Rates: Individual tax rates for middle-income Americans are reduced from 25 percent to 22 percent, 28 percent to 24 percent, and 33 percent to 32 percent, which will help taxpayers keep even more of their hard-earned money. The bill also makes permanent the 20 percent corporate tax rate.

- Small Business:

- Pass-Throughs: This bill enables small business owners to keep more of their hard earned dollars, as less of their income will be taxable. It allows owners of pass-throughs (S-corps, partnerships, limited liability companies and sole proprietorships) to deduct 23% of qualified pass-through income from their overall personal income tax liability.

- Section 179 Expensing: Allows businesses to deduct the full cost of a piece of equipment used in a business, rather than depreciating it over many years. The bill increases the section 179 expensing maximum deduction from $500,000 to $1,000,000. This will provide immediate and practical relief to business owners in every industry throughout Alaska, keeping pace with the reality of today’s business environment.

- Small Brewers: Cuts the excise tax on small brewers in half. With dozens of small brewers in Alaska and growing, this will make a positive impact on not only producers but also consumers.

- Home Mortgage Interest Deduction: The bill keeps current law treatment for mortgages taken in acquiring a home but repeals the deduction for interest with respect to home equity loans.

- Death Tax: Doubles the exemption amount for the federal estate, gift, and generation-skipping transfer taxes from $5 million to $10 million. This will provide relief for many Alaskans such as fishermen with vessels, gear, permits, quota, and other business and personal capitalization.

- Individual Mandate Tax Penalty: Eliminates this burdensome tax penalty levied on people who couldn’t afford insurance or chose not to. By repealing the individual mandate, nothing else about the structure of the Affordable Care Act would be changed, those who qualify for subsidies will still be able to retain them.

- Settlement Trust Improvement Act: Includes an amendment by Senator Murkowski permitting Native Corporations to deduct from their taxable income the amount of any contribution of cash or assets that the Native Corporation makes to a Settlement Trust and to assign certain payments described in the Alaska Native Claims Settlement Act (ANCSA) to a Settlement Trust without having to recognize any associated income, encouraging Native Corporations to make those contributions.

- Cruise Ships: Includes an amendment by Senator Sullivan to strike a tax hike that disproportionately impacted the Alaska economy and its workers, particularly in communities that rely on cruise ship tourism. For the many ports of call throughout the Inside Passage, and elsewhere across Alaska, this amendment was important to ensure local businesses and tourism reliant communities – who rely on the more than one million cruise ship passengers who visit Alaska each year – would not be negatively impacted by this bill.